Bitcoin could rise to $100,000, analysts say: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

Crypto analysts are predicting a continued move higher in bitcoin after the cryptocurrency jumped past $95,000, breaking through a level that previously marked strong selling pressure.

"Technically, BTC now has a clear path towards the $100-106K area, limited by the psychologically crucial round level from below and the 200-day MA from above," Alex Kuptsikevich, chief market analyst at The FxPro said in an email, using an acronym for moving average.

Charts are painting a strong bullish picture with prices trading above $95,000, the highest since Nov. 17 and well above the 50-day simple moving average, he said.

Gains in precious metals, typically seen as havens at times of geopolitical unrest, are key to lifting bitcoin higher, said Singapore-based QCP Capital.

"If metals keep catching a debasement bid, BTC’s relative value may pull flows back into digital assets," it said.

The firm explained that the "Goldilocks" macroeconomic scenario — not too hot, not too cold — is driving renewed risk-taking across markets.

"Goldilocks still holds: U.S. jobs look steady and inflation remains stable. Risk is back across the board, from equities and precious metals to the dollar and crypto," QCP Capital said.

Market flows are signaling bullish vibes, too. On Deribit, the largest crypto options exchange, call options at $96,000, $98,000, and $100,000 strikes saw the most action over the past 24 hours. These calls are a bet that BTC's price will climb, eventually reaching six figures.

In a report shared with CoinDesk, Galaxy warned the Senate crypto bill could pave the way for the biggest financial surveillance expansion since the Patriot Act. This could potentially allow authorities to freeze DeFi front-ends and transactions, boosting the appeal of privacy-preserving tokens such as monero (XMR) and zcash (ZEC).

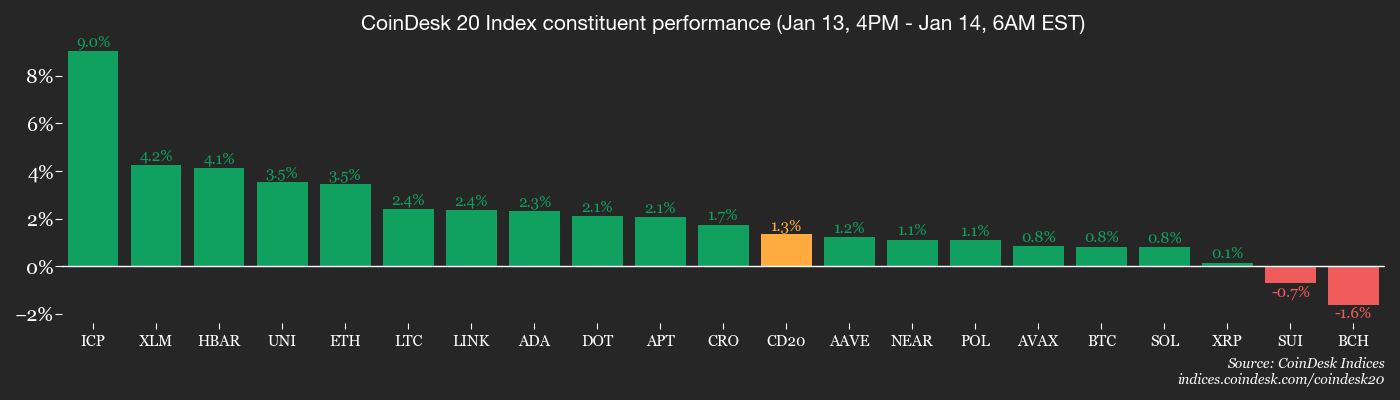

Bitcoin recently traded at $94,711, up 3.04% over 24 hours. Major altcoins such as ether (ETH), XRP (XRP), dogecoin (DOGE), and cardano (ADA) have risen by around 5%, while solana (SOL) and BNB (BNB) have lagged.

Smaller tokens have chalked out bigger rallies as evidenced by the 11% gain in the CoinDesk Metaverse Select Index and the 8% rise in the Culture & Entertainment Select Index. The memecoin index gained over 6%.

In traditional markets, silver hit another record high, topping $91.50 per ounce. Gold is taking a breather near the lifetime high of $4,634 registered this week. Stay alert!

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Jan. 14, 2 a.m.: Mantle (MNT) mainnet upgrade (v.1.4.2) is focused on supporting all features of Ethereum’s Fusaka upgrade.

- Macro

- Jan. 14, 8:30 a.m.: U.S. Nov. PPI. Headline rate YoY Est. 2.7%, MoM Est. 0.2%; Core rate YoY Est. 2.7%, MoM Est. 0.2%.

- Earnings (Estimates based on FactSet data)

- Nothing scheduled

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Jan. 14: Arbitrum to host an X Spaces session with HuddlePad.

- Jan. 14: PancakeSwap and Stellar to host a conversation on bringing blockchain into the real world.

- Jan. 14: NEAR Protocol to host an Ask Me Anything (AMA) session with Meta Pool.

- Unlocks

- No major unlocks.

- Token Launches

- Jan. 14: Injective to start its Community BuyBack program.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 1 of 2: Web 3.0 Expo Dubai Edition (UAE)

Market Movements

- BTC is up 0.66% from 4 p.m. ET Tuesday at $94,869.35 (24hrs: +3%)

- ETH is up 3.31% at $3,296.81 (24hrs: +5.2%)

- CoinDesk 20 is up 0.93% at 3,021.85 (24hrs: +3.65%)

- Ether CESR Composite Staking Rate is up 1 bps at 2.79%

- BTC funding rate is at 0.0066% (7.2051% annualized) on Binance

- DXY is down 0.10% at 99.03

- Gold futures are up 0.98% at $4,644.40

- Silver futures are up 4.70% at $90.39

- Nikkei 225 closed up 1.48% at 54,341.23

- Hang Seng closed up 0.56% at 26,999.81

- FTSE is up 0.32% at 10,169.66

- Euro Stoxx 50 is down 0.01% at 6,029.41

- DJIA closed on Tuesday down 0.80% at 49,191.99

- S&P 500 closed down 0.19% at 6,963.74

- Nasdaq Composite closed down 0.10% at 23,709.87

- S&P/TSX Composite closed little changed at 32,870.36

- S&P 40 Latin America closed down 0.11% at 3.268,35

- U.S. 10-Year Treasury rate is down 1.9 bps at 4.152%

- E-mini S&P 500 futures are down 0.36% at 6,976.25

- E-mini Nasdaq-100 futures are down 0.54% at 25,766.50

- E-mini Dow Jones Industrial Average Index futures are down 0.28% at 49,271.00

Bitcoin Stats

- BTC Dominance: 59.18% (-0.14%)

- Ether to bitcoin ratio: 0.03506 (0.63%)

- Hashrate (seven-day moving average): 1,024 EH/s

- Hashprice (spot): $41.15

- Total Fees: 2.95 BTC / $273,718

- CME Futures Open Interest: 119,165 BTC

- BTC priced in gold: 22.6 oz

- BTC vs gold market cap: 6.36%

Technical Analysis

- The chart shows daily changes in the number of BTC/USD long positions (bullish bets) on Bitfinex in candlestick format.

- The tally has declined to 71,368 from 72,926 a week ago, offering bullish cues to bitcoin.

- Historically, the number of longs has been a contrary indicator.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $252.69 (+4.00%), +0.85% at $254.85 in pre-market

- Circle Internet Group (CRCL): closed at $83.46 (+0.68%), +0.90% at $84.21

- Galaxy Digital (GLXY): closed at $26.82 (+5.22%), +2.09% at $27.38

- Bullish (BLSH): closed at $38.68 (–3.30%), +1.55% at $39.28

- MARA Holdings (MARA): closed at $10.95 (+2.82%), +1.55% at $11.12

- Riot Platforms (RIOT): closed at $16.75 (+1.82%), +1.43% at $16.99

- Core Scientific (CORZ): closed at $18.03 (+3.15%), +0.89% at $18.19

- CleanSpark (CLSK): closed at $12.55 (+4.93%), +1.59% at $12.75

- CoinShares Bitcoin Mining ETF (WGMI): closed at $48.87 (+2.82%)

- Exodus Movement (EXOD): closed at $18.10 (–0.82%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $172.99 (+6.63%), +2.53% at $177.36

- Semler Scientific (SMLR): closed at $20.34 (–9.64%)

- SharpLink Gaming (SBET): closed at $10.54 (+2.73%), +3.89% at $10.95

- Upexi (UPXI): closed at $2.31 (+3.59%)

- Lite Strategy (LITS): closed at $1.49 (+2.76%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $753.8 million

- Cumulative net flows: $57.26 billion

- Total BTC holdings ~1.3 millionngs ~ million

Spot ETH ETFs

- Daily net flows: $130 million

- Cumulative net flows: $12.59 billion

- Total ETH holdings ~6.09 million

Source: Farside Investors

While You Were Sleeping

- Bitcoin prices hit a two-month high, but U.S. demand lags (CoinDesk): A negative Coinbase premium indicates that bitcoin is trading at a discount on U.S. venues compared with offshore exchanges, signaling muted American buying interest even as global demand pushes prices higher.

- Wall Street Is Suddenly on the Defensive With the President (The Wall Street Journal): A string of consumer-first proposals and pressure on the Federal Reserve have rattled investors, underscoring a shift in White House priorities away from markets and toward voters.

- Trump urges Iranians to keep protesting, saying 'help is on its way' (Reuters): The president’s call comes amid a deadly crackdown that killed about 2,000 people, with Tehran accusing Washington of incitement as Trump declines to specify what form any U.S. support might take.